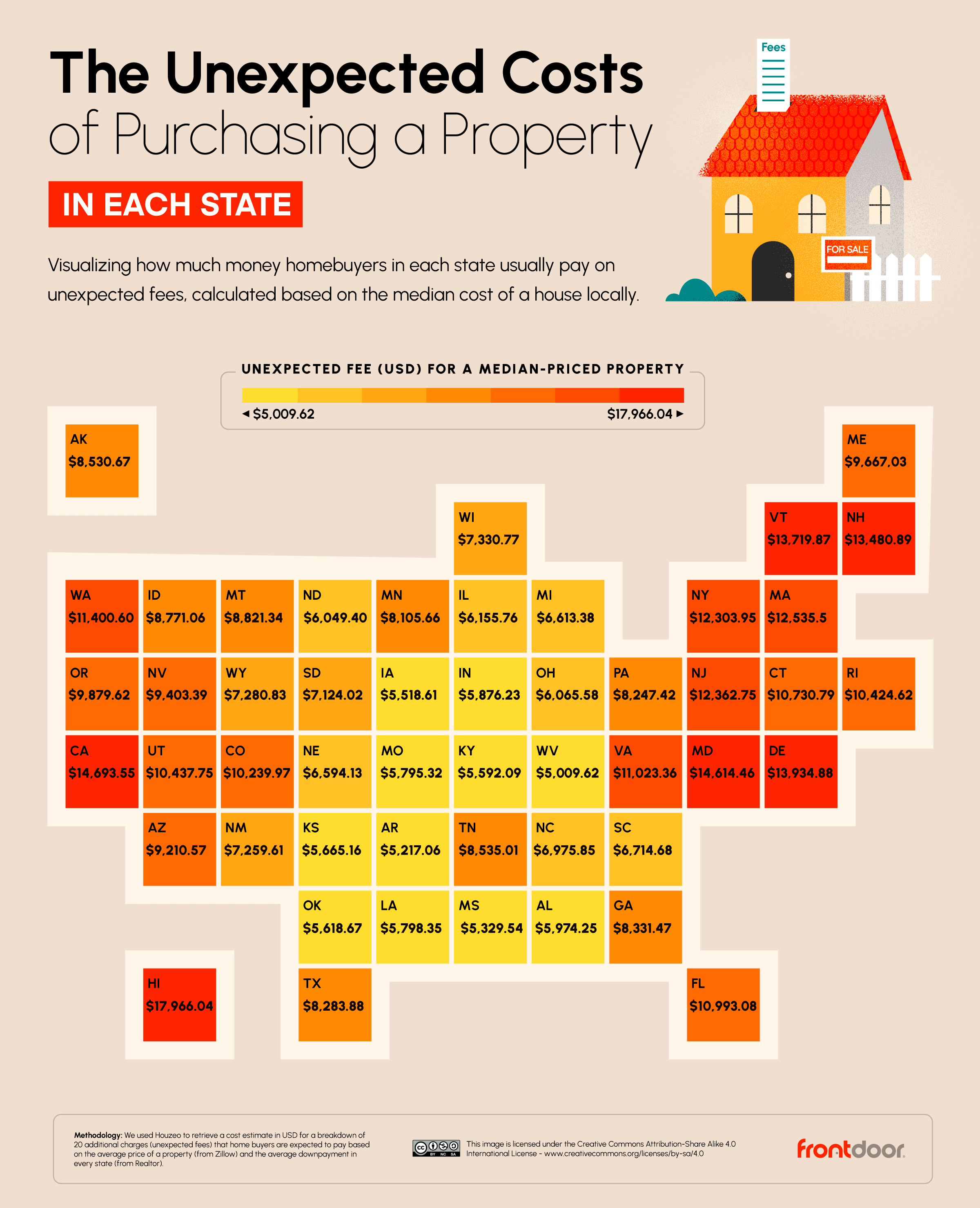

Buying a home is expensive enough as it is, but unexpected fees can add thousands of dollars to the final sum homebuyers end up forking out.

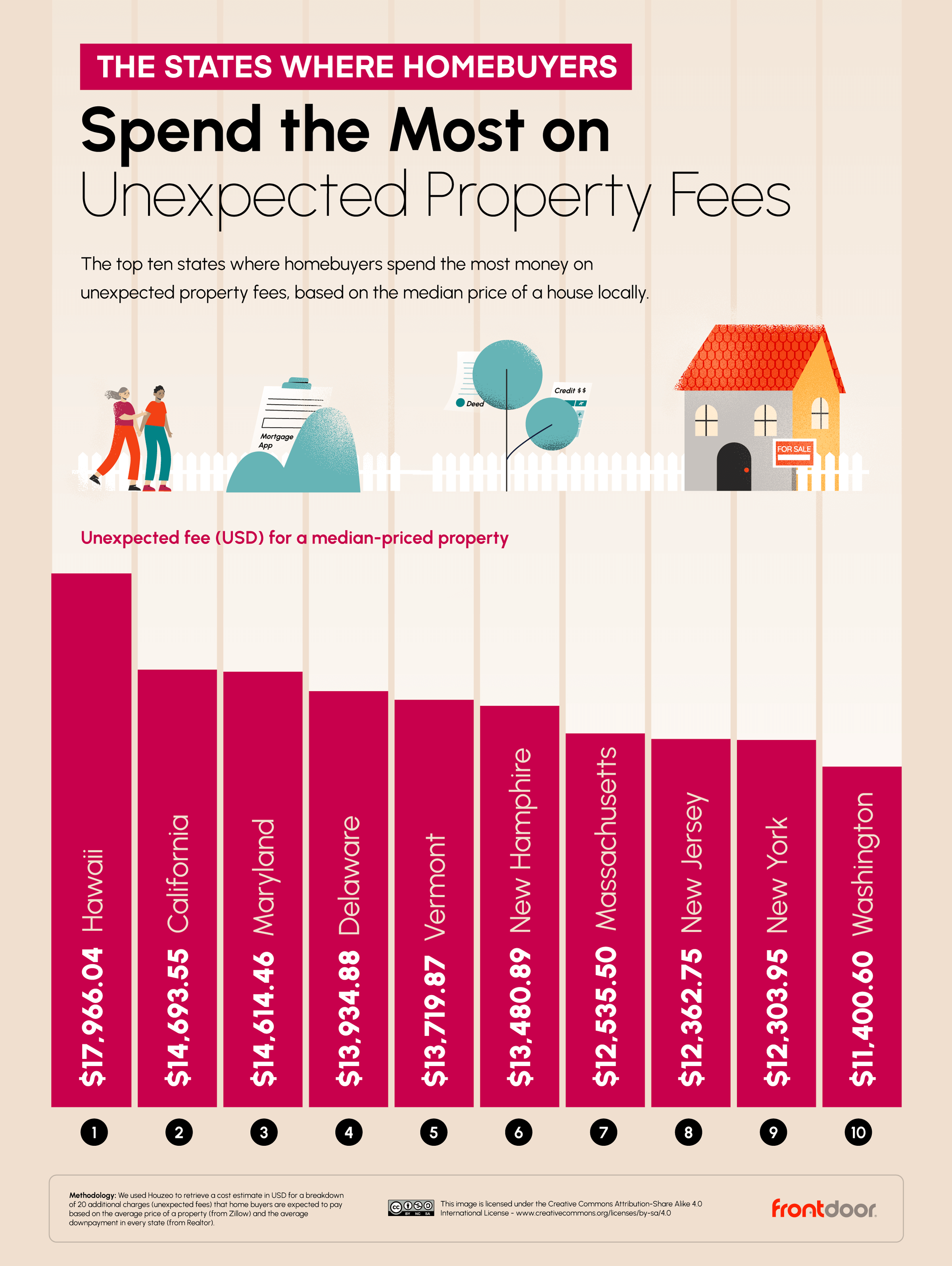

To find out where in the US people are spending the most on hidden homebuyer costs, Frontdoor worked out state-by-state price estimates for the most common additional homebuyer charges — including origination charges, appraisal and survey fees, taxes and owner title insurance — and ranked the states by highest unexpected cost, based on the average price of a local property.

Hawaii is home to the highest hidden home fees, with the average homebuyer shelling out almost $18,000, based on the state's median house price. In West Virginia, on the other hand, additional charges amount to just $5,009, on average — the lowest sum of any state.

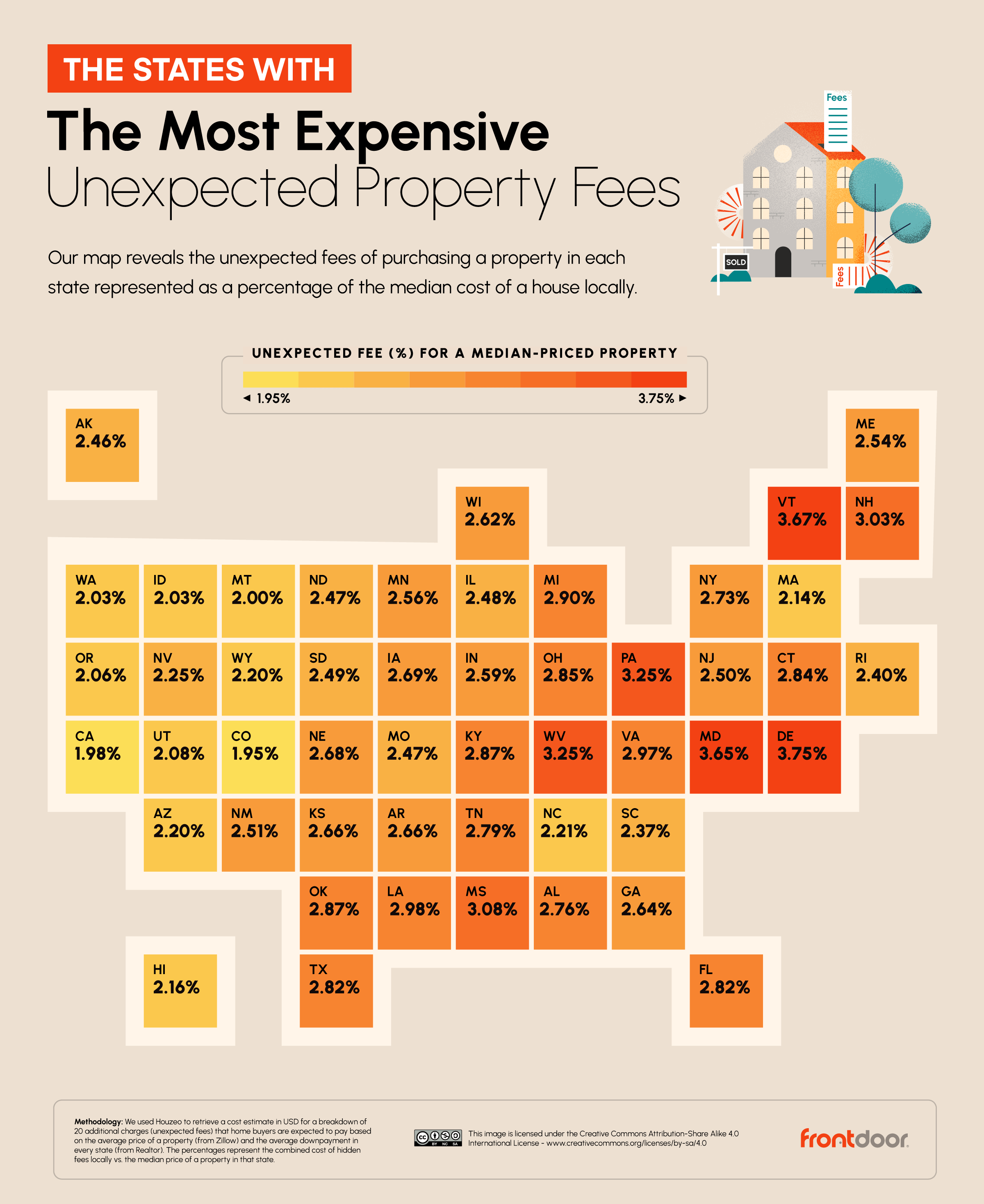

Looking at unexpected costs as a share of the average local property price, however, Colorado has the lowest additional fees (1.95 percent) and Delaware has the highest (3.75 percent).

Click images to enlarge

Via Frontdoor.